At Mindful Marketing, I’ve recently started offering a new service to my clients – micro-consulting in the form of mastermind sessions.

The offering is simple – clients present their strategic problems to me, and I conduct quick research to come up with a framework to address them.

It’s a win-win situation for both my clients and me because we move quickly to find a solution to a significant issue in a short amount of time.

One such challenge came from a client who runs an FMCG business.

His product was in a highly mature market, and growth had become stagnant, leaving no room for further expansion.

Although the cash flow from the product segment was stable, he was worried about the future of his business because he didn’t have a “star product” in his portfolio – one that operates in a high-growth market and has the potential for significant revenue generation and cash flow.

During our mastermind session, I introduced him to the barbell strategy – the brainchild of the renowned author Nassim Nicholas Taleb, known for books like “The Black Swan” and “Fooled by Randomness”.

Taleb introduced the term “barbell” to describe a strategy for managing the risk of extreme events.

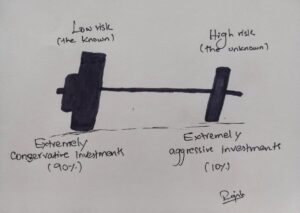

In investing, the barbell strategy involves putting most of our resources in safe, low-risk investments like government bonds, cash, or high-grade corporate bonds, and a small portion in high-risk, high-reward opportunities.

(My hand-drawn image that illustrates the barbell strategy)

The barbell strategy is like growing a garden.

You plant some seeds in a fertile, well-tended plot that will reliably produce a yield, providing you with a steady supply of fresh fruits and vegetables.

At the same time, you also plant some experimental crops in another plot, taking some risks with new and untested varieties.

While there’s a chance that some of these crops may fail, others may turn out to be incredibly successful, leading to a bountiful harvest and providing you with exciting new options for your meals.

By combining the safe and risky approaches, you create a diverse and robust garden that can weather any storms and provide a rich and satisfying yield.

Now, let’s apply this to my FMCG client’s case.

While his existing product portfolio brings stable cash flow, he also needs to invest in research and development efforts to identify new products for future growth.

Like the barbell strategy, he needs to consistently invest a smaller portion of his cash flow in long-term, high-risk, and high-reward opportunities.

This requires a shift in mindset, with a willingness to embrace failures as part of the testing and experimenting process.

It’s like being a scientist in a lab, trying out new hypotheses and eagerly awaiting the one breakthrough that could lead to a major discovery.

For my client, if even one new product idea clicks, it could be a jackpot that propels his business to new heights.

Not just my client, all of us can become more antifragile by following the barbell strategy, which involves investing a small percentage of resources in high-risk, high-reward opportunities, while still maintaining a strong focus on low-risk and stable investments.

This approach can help us thrive in the face of chaos and uncertainty.

The Chinese proverb “Dig your well before you’re thirsty” perfectly captures the essence of the Barbell strategy, emphasizing the importance of being prepared for future challenges by investing in new opportunities before the mainstream ones dry up.